Imagine a car buyer.

They’ve built their perfect car online–chose their model, selected the interior, and added special features—only to get to their local dealership and find their data lost.

This data disconnect between parent organizations and dealerships doesn’t just impact the user. It breaks down the customer journey and negates an automotive brand’s personalization, attribution, and targeting efforts.

This disruption in personalization, attribution, and targeting are some of the biggest challenges automotive brands face with their middle-of-funnel marketing. Across the hundreds of dealership domains, CRMs, and active campaigns, many opportunities exist to disrupt data.

This is exactly why the middle funnel should be the focus of any automotive brand’s data efforts. A little coordination can pay big dividends.

Start at the bottom of the funnel

Step one for success in the murky middle is understanding why, when, and where conversions occur.

Demographic, attribution, media consumption, and other data types combine to create a picture of ideal consumers. It also tells you your biggest missed opportunities, growing consumer types, and many other interesting stories.

Having a baseline of what your customers look like and what marketing/sales activities work today will guide you as you embrace new strategies, technologies, and models.

Essential things to consider:

- Your prospects & customers: Both current and aspirational customers

- Their customer journey: Emotional and rational wants and needs, what media they consume, plus how, when, and why these activities occur.

Once you have a complete picture of your bottom-of-funnel outcomes, you can begin to tinker. But first, you need a future-ready data architecture.

Establish a modern data architecture

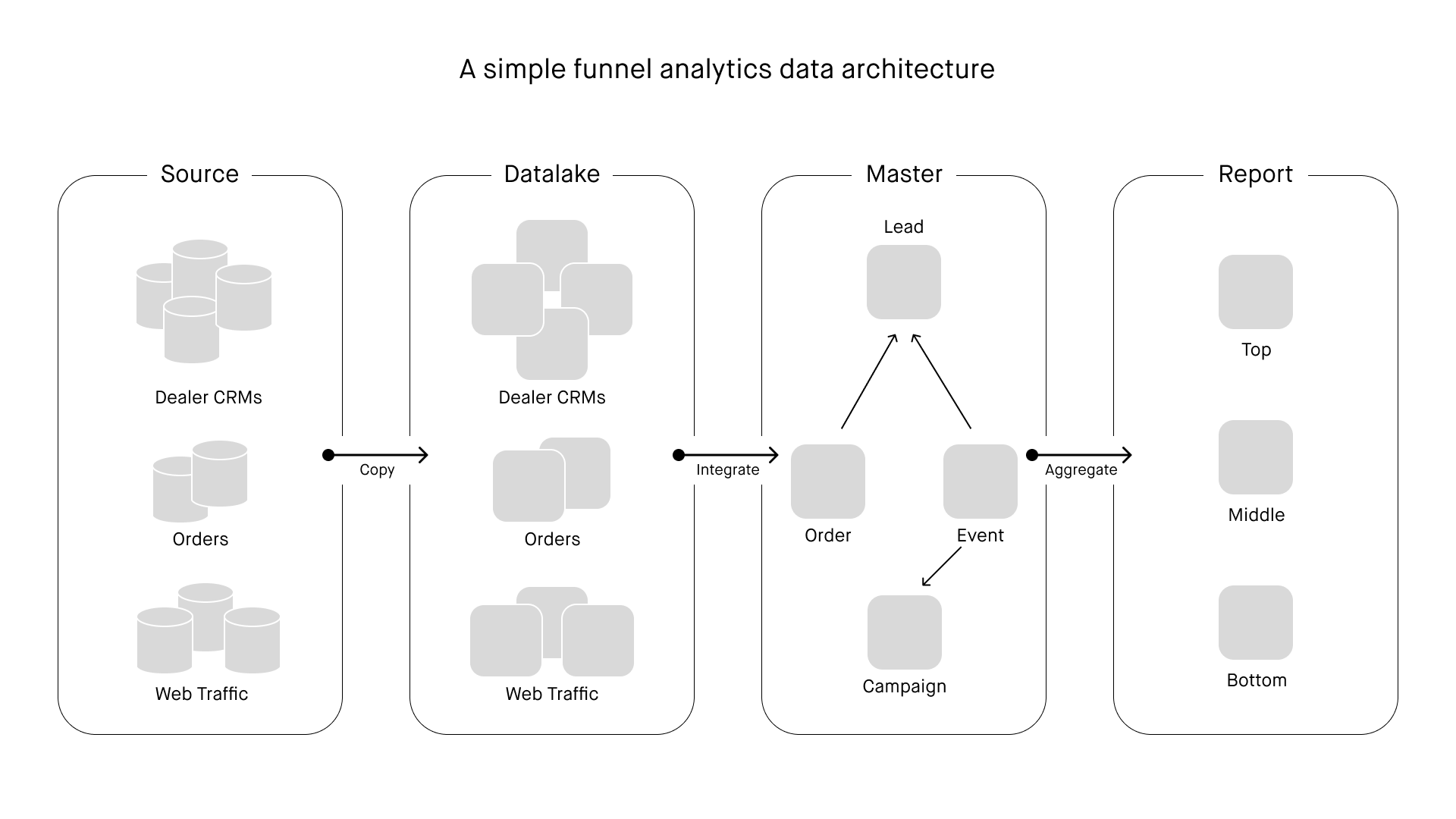

Your entire funnel depends on reliably-integrated data from dealers and the parent manufacturer. A data architecture outlines the organizational principles describing how raw material gets turned into a finished report.

Modern data architecture borrows a lot from car manufacturing, so the model should be familiar:

- Identify where you collect the data for your funnel. Look for 80% or better coverage across dealer CRMs, order management systems, web traffic, etc. Call that your Source layer.

- Copy as much of that source data (securely!) as possible into a cloud database. Keep those records untouched. Call that your Data Lake layer.

- Iteratively refine raw data into a clean lead record in a second cloud instance. Integrate web events, marketing campaigns, products, and anything else valuable in your raw data too. That’s your Master layer.

- Integrate that clean data into a Funnel record in a third cloud database for final assembly as your funnel report. That’s your Report layer.

Work with the dealers to fill the holes in your data, and monitor data quality when you copy from one place to the next, just as you would on the assembly line.

Build a lead-scoring model

While you begin to collect and standardize data, build a lead-scoring model that optimizes for customer experience. This will likely need dealer assistance, so ask them for help. Choose your priorities, and train your lead-scoring model to hit them. Maybe you want to prioritize certain kinds of customers or the most likely close rates.

Whatever your goal, you’ll also need to provide top- and bottom-of-funnel data to the model. Stick with the model, and learn how to improve it with better standardization and sharper predictions.

This collaborative process of building mutually-beneficial analytics will help create a positive feedback loop. This virtuous circle makes it even clearer by the week why good data is to everyone’s benefit.

It will also optimize your funnel by prioritizing qualified visitors that make it to the middle of the funnel, allowing you to identify more of their unique features over time.

Expect you’ll surface data quality issues on the road to good data. Your most likely sources of quality issues will be idiosyncratic data entered in the dealerships or disconnects in your marketing campaigns. Approach data entry at the dealerships and in your marketing tools with some of the disciplines you apply to quality on the assembly line. Standardization starts with positive communication, continues with periodic reminders, and survives on collaboration incentives.

Every discovery of a data quality issue results in better data for everyone, so actively reward people for finding opportunities to make their data entry more reliable.

Incentivize dealerships & sales associates

Communication between the automotive brand and its dealerships helps both global and local teams win. Here’s an easy way to create a win-win for middle-of-funnel visibility.

First, encourage a collaborative approach to data sharing and strategy development, and discuss why standardizing data collection is beneficial. Establish clear channels for information exchange to ensure all parties align on lead management objectives.

Motivate individual dealerships to provide standardized lead information after each closed/lost or closed/sale. Recognize and reward their efforts to gather and share valuable lead data.

By adopting these recommendations, automotive companies can leverage the middle of the funnel to improve conversion rates. Embracing analytics transformation, data integration, and personalization/AI will help brands better understand customer behavior and deliver a superior customer experience.

Featured work

Autobytel data transformation

A while back, DEPT®’s data team helped Autobytel conduct a company-wide business transformation with an analytics platform. We modernized their data platform, supported a new site-based advertising model, and optimized their dealership lead-management product.

The solution had three foundations:

- A new site analytics taxonomy using Adobe Analytics best practices to optimize for site-based ad revenue

- A data warehouse reboot, with refactored core data models and data pipelines, helped the enterprise shift from a reactive report-driven organization to an analytics-led decision-making one

- A rebuilt lead-scoring engine to identify quality leads and match them with the most impactful dealers

From this collaboration, Autobytel completed its data-driven transformation, adding new revenue streams and increasing the profitability of its existing products.