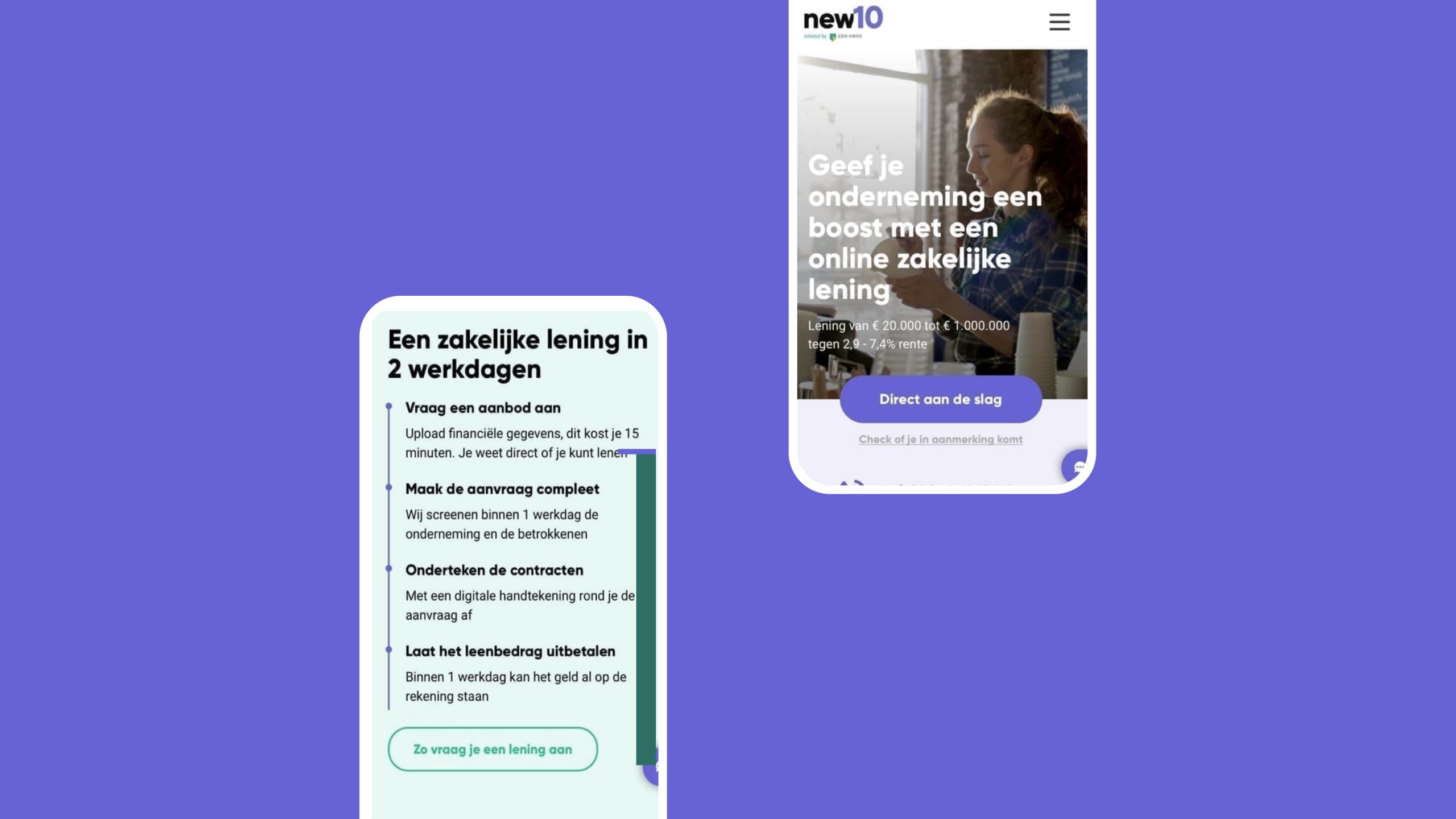

Knowing if you’re eligible for a loan within 15 minutes and having the money in your account two days later. And all that online. It is now possible. Corporate Startup ‘New10’ offers entrepreneurs the best of both worlds: the agility of the startup with the financial knowledge of the bank. Together with New10, DEPT® brought the brand to life with a new online platform and an in-house dream team.

All steps are digital: easy and flexible

New10 was founded by ABN AMRO based on the idea that entrepreneurs prefer to build their business without hassle and obstacles. That is why New10 offers its business loans online. It puts entrepreneurs at the center, going through the application at their own pace, wherever and whenever they want. From uploading financial data to signing the contract: all steps are digital. Super easy and flexible.

We created a smart mix of technology and data

For a (corporate) startup, brand building is just as important as ever. In fact, it can make all the difference. That is why Studio Dumbar (part of Dept) gave shape to the name, positioning, brand story, pay-off, and visual identity of New10, working closely with its founders. In the visual translation, they sought a balance between trust and the speed and ‘hipness’ of a new start-up. After the launch, the brand was expanded with a smart (radio) campaign to generate further publicity.

Technology and data

With a smart mix of technology and data, New10 is the only fully online lender in the Netherlands. From applying, to signing and paying: all steps in the customer journey have been made as simple as possible, using data that is retrieved from existing systems such as the Chamber of Commerce. In a digital, fully automated assessment process, New10 checks whether a company is healthy and reliable enough to qualify for a loan. A unique model has been implemented that automatically calculates the risk profile of the client on the basis of annual figures and transaction data. This all goes without the client being questioned and without the speed of that process leading to higher interest rates, as is often the case with other fintechs.

The right people

Together with ABN AMRO and DEPT®’s freelance community we looked for a close-knit team of internal and external talents to get this job done. A close, but also flexible team, that is able to quickly change its composition and works towards a single goal: putting the client at the center. Stringing together all this talent in the field of creativity, data and technology has resulted in a time-to-market of less than a year.

Results

Getting the right people together is the first step, but then they also have to be able to work together in the most efficient way. That is why a great deal of time has been invested in setting up and connecting tools for presenting all information in the right way to the right roles in a seamless process. This way we give New10 the tools to lend money easier and cheaper than competitors in the market. The cooperation with ABN AMRO plays a crucial role in this. New10 combines the financial know-how of the parent company with the agility of a lean startup. A ‘Corporate Startup’ done right.

And the results? New10 has been in the air for five months now and customers are very satisfied with the speed, convenience and clarity of the loan process. A clear advertising campaign ensures the increase of new customers who feel attracted by New10’s human angle. According to customer feedback, financial parties are rarely this personal and approachable.

- Since the start at the end of September more than 5000 entrepreneurs have created an account.

- More than fifty loans were finalized at the end of 2017.

- Customers highly appreciate New10’s proposition, with an NPS of 60+.

- New10 lets entrepreneurs know within 15 minutes if they are eligible for a loan.

Questions?

UX Design & Research Lead

Franklin Schamhart

Discover more